Premium Finance Market Size to Reach USD 132.88 Bn by 2032 | Driving Growth in Premium Finance Companies

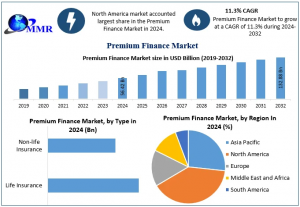

Global Premium Finance Market, valued at USD 56.42 Billion in 2024, is projected to reach USD 132.88 Billion by 2032, growing at a CAGR of 11.3%.

Rising insurance penetration, digital innovation, and strategic partnerships are fueling the Premium Finance Market, transforming how premiums are financed globally.”

WILMINGTON, DE, UNITED STATES, October 24, 2025 /EINPresswire.com/ -- Global Premium Finance Market Overview: Digital Transformation and Rising Insurance Penetration Driving Next-Generation Insurance Premium Financing Growth— Dharti Raut

Global Premium Finance Market is rapidly reshaping the insurance premium financing industry, driven by rising insurance penetration, digital transformation, and innovative premium financing solutions. Strategic partnerships, technological advancements, and increasing adoption among high-net-worth clients are unlocking significant opportunities for banks, NBFCs, and FinTech providers. With evolving market trends, regulatory developments, and emerging regional expansions, the Premium Finance Market is poised for sustained growth, enhanced profitability, and transformative impact on global insurance premium financing solutions.

Gain Valuable Insights – Request Your Complimentary Sample Now @ https://www.maximizemarketresearch.com/request-sample/213507/

Global Premium Finance Market Growth Drivers: Digital Transformation and Rising Insurance Penetration Powering Global Expansion

Global Premium Finance Market is accelerating rapidly as rising insurance penetration, digital transformation, and innovative financing models reshape how individuals and businesses manage insurance premiums. Driven by growing liquidity needs, technological advancements, and strategic partnerships, the Premium Finance Market Size continues to expand, unlocking powerful opportunities for premium finance providers, financial institutions, and investors across global insurance financing solutions.

Global Premium Finance Market Challenges: Fluctuating Interest Rates, Credit Risks, and Regulatory Hurdles Impacting Global Insurance Financing Growth

Global Premium Finance Industry faces challenges from fluctuating interest rates, credit risks, and stringent regulatory frameworks. Economic downturns, cybersecurity threats, and operational inefficiencies further test market resilience. Addressing these premium finance market restraints is crucial for sustaining long-term growth, operational stability, and investor confidence within the global insurance premium financing market.

Global Premium Finance Market Opportunities: Digital Innovation, Emerging Markets, and AI-Powered Insurance Financing Driving Global Growth

Global Premium Finance Market is unlocking vast opportunities through digital innovation, emerging market expansion, and strategic FinTech and InsurTech partnerships. Rising demand for non-life insurance premium financing, wealth management solutions, and AI-powered premium finance platforms is reshaping the landscape of global insurance premium financing. These advancements position key market players to capitalize on next-generation growth, enhanced profitability, and accelerating digital transformation trends across the global premium finance industry.

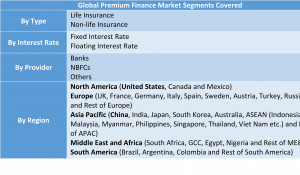

Global Premium Finance Market Segmentation: Life Insurance, Interest Rates, and Leading Providers Driving Global Insurance Financing Growth

Global Premium Finance Market is strategically segmented by type, interest rate, and provider, offering critical insights into market dynamics and growth opportunities. The Life Insurance segment dominates due to high-value premiums, long-term contracts, and wealth management applications, while Fixed Interest Rate financing provides predictable repayment solutions. Leading premium finance providers, including banks, NBFCs, and other financial institutions, drive market expansion. Understanding these Premium Finance Market segments is essential for investors and industry stakeholders to capitalize on emerging trends in global insurance premium financing solutions.

Feel free to request a complimentary sample copy or view a summary of the report @ https://www.maximizemarketresearch.com/request-sample/213507/

Global Premium Finance Market Trends: Digital Platforms, Customized Financing, and Interest Rate Dynamics Shaping Global Insurance Financing Growth

Digital Platforms and Automation: Adoption of digital Premium Finance Market platforms and InsurTech solutions is streamlining loan approvals, automating payments, and enhancing accuracy in global insurance premium financing solutions.

Customized Financing Solutions: Premium Finance Market providers offer tailored fixed and floating interest rate options and flexible payment plans, meeting growing demand for personalized insurance premium financing worldwide.

Interest Rate Dynamics: Fluctuating interest rates significantly influence borrowing costs and insurer returns, shaping demand for premium finance loans and driving growth opportunities in the Global Premium Finance Market.

Global Premium Finance Market Developments: Strategic Transactions, Innovative Financing, and Industry Education Driving Global Insurance Growth

In November 2024, Colonnade Advisors successfully facilitated its third Premium Finance Market transaction of the year, underscoring its strategic advisory role in the evolving global insurance premium financing landscape.

In January 2025, Insurance and Estate Strategies LLC introduced the Kai-Zen strategy, democratizing premium financing solutions by extending access to high-net-worth individuals with incomes between $100,000 and $500,000, thereby broadening the Premium Finance Market reach.

As of August 2025, the Banking Truths Team has been actively educating financial professionals on the nuances of Premium Finance Market trends, emphasizing its role in wealth management, estate planning, and insurance premium financing solutions, thereby enhancing industry knowledge and adoption globally.

Global Premium Finance Market Competitive Landscape:

Global Premium Finance Market Competitive Landscape is dominated by traditional banks and financial institutions, leveraging strategic partnerships, mergers & acquisitions, and geographic expansion. Focused on high-net-worth clients, these key players drive Premium Finance Market penetration, offering comprehensive insurance premium financing solutions and reshaping the global insurance premium financing industry across North America, Europe, Asia-Pacific, and LAMEA.

Global Premium Finance Market Regional Insights: North America and Europe Driving Global Insurance Premium Financing Growth

North America leads the Global Premium Finance Market, driven by high insurance penetration, robust economic growth, and diverse insurance products. The United States Premium Finance Market and Canada Premium Finance Market offer extensive opportunities for premium finance providers, with strong adoption of life and non-life insurance premium financing solutions, positioning the region as a critical hub in global insurance premium financing.

Europe’s Premium Finance Market thrives in mature insurance landscapes, with the UK, Germany, and France Premium Finance Markets leading adoption of premium financing solutions. Growing regulatory compliance and digitalization in insurance premium financing enhance efficiency and accessibility, positioning Europe as a key region for strategic expansion and innovation in the Global Premium Finance Market.

Global Premium Finance Market Key Player:

Colonnade

Banking Truths Team

Insurance and Estate Strategies LLC

AGENTSYNC, INC.

The Annuity Expert

J.P. Morgan Private Bank

Tennessee

Capital for Life

Generational Strategies Group, LLC.

BNY Mellon Wealth Management

Byline Bank

Succession Capital Alliance

Symetra Life Insurance Company

Lions Financial

Wintrust

Evolution, Inc.

Parkway Bank & Trust Company

Agile Premium Finance

AFCO Insurance Premium Finance

BankDirect Capital Finance

Valley National Bank

ARI Financial Group

Peoples Premium Finance

FMG Suite

Schechter

US Premium Finance

Lincoln National Corporation

FAQs:

What is driving the growth of the Global Premium Finance Market?

Ans: Rising insurance penetration, digital transformation, innovative financing models, and strategic partnerships are fueling the expansion of the Global Premium Finance Market, boosting adoption of insurance premium financing solutions worldwide.

Which regions dominate the Premium Finance Market?

Ans: North America Premium Finance Market leads globally, followed by Europe Premium Finance Market, driven by high insurance penetration, mature markets, and growing adoption of premium finance solutions and insurance financing platforms.

Who are the key players in the Global Premium Finance Market?

Ans: Major participants in the Premium Finance Market include Colonnade Advisors, Banking Truths Team, Insurance and Estate Strategies LLC, J.P. Morgan Private Bank, and other banks, NBFCs, and financial institutions driving global insurance premium financing growth.

Analyst Perspective:

Industry observers note that the Global Premium Finance Market is experiencing significant momentum, fueled by increasing insurance penetration, digital innovation, and customized Premium Finance Market solutions. Rising adoption among high-net-worth clients and strategic collaborations among banks, NBFCs, and InsurTech providers highlight competitive dynamics, creating substantial opportunities for investors and new entrants seeking long-term growth and value in the Premium Finance Market sector.

Related Reports:

Microfinance Market: https://www.maximizemarketresearch.com/market-report/microfinance-market/230628/

Decentralized Finance Market: https://www.maximizemarketresearch.com/market-report/decentralized-finance-market/203718/

Supply Chain Finance Market: https://www.maximizemarketresearch.com/market-report/supply-chain-finance-market/168082/

Maximize Market Research is launching a subscription model for data and analysis in the

Premium Finance Market: https://www.mmrstatistics.com/markets/320/topic/699/consumer-services

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

sales@maximizemarketresearch.com

Lumawant Godage

MAXIMIZE MARKET RESEARCH PVT. LTD.

+ +91 96073 65656

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.